A Credit Card Authorization Form is a document that businesses use to secure permission from customers to charge their credit cards for specified purchases or services. Utilizing a template for these forms offers several benefits, including ensuring a consistent and professional presentation that builds trust with customers. It simplifies the authorization process, making it easier for both businesses and customers to complete transactions efficiently.

5 min read Asif Khan Written ByContent Editor & Writer Asif is a research expert and seasoned content editor, holding a degree in English Literature and Linguistics. With over three years of professional writing experience, he excels in simplifying complex and technical topics for diverse audiences. At WordLayouts, Asif leverages his expertise to decode intricate templates designed by engineers, ensuring users can fully comprehend and utilize these resources effectively.

Credit card payments are popular means of payment and as a business, you should be prepared to handle such transactions such that you avoid chargebacks and protect the client’s card details. One common scenario you should be aware of is completing payments when the client’s physical card is not present – for example when a customer uses someone else’s credit card. In such cases, you should have the cardholder sign a credit card authorization form. The document helps you get permission to charge the customer’s card a specified one-time or recurrent amount for the stipulated period of time. So, you can use it for bills you charge weekly, monthly, annually, or any other interval while avoiding chargebacks and fraudulent transactions. Chargebacks can bring huge cash flow problems especially if the money is withheld by the card issuer for a long time. Also, they can be tough to follow up without proper documentation. That is why we have designed a credit card authorization form template to help you avoid such cases.

As a vendor in any line of business, whether selling groceries at a local store or clothes retailer, you will find this template a helpful tool in your arsenal. It ensures you collect all the necessary details required for payments to be approved by the card issuer and keep a record of such requests.

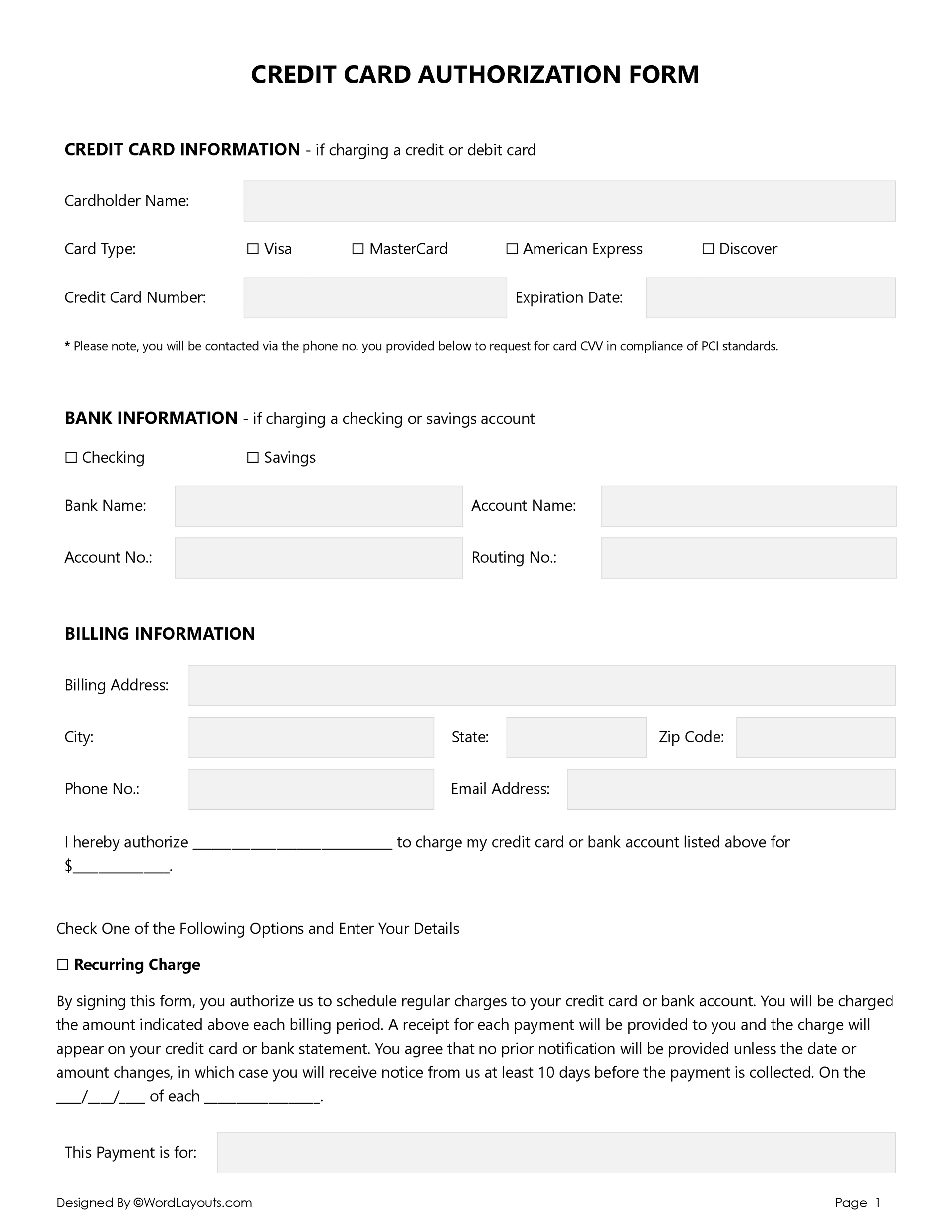

We have identified all the sections needed in a credit card authorization form and incorporated them into this template. We have further designed it to make sure it is useable for both one-time payment authorization and recurring payment authorization. Here is how to fill out this form.

Credit card information identifies the card issuer and collects details about the cardholder and the card to be used for the transaction. Details needed to get approval include the cardholder’s name, card type, credit card number, and expiration date. To maintain PCI standards, the CVV field is not included, and you will contact the cardholder for CVV at the time of the transaction. The card information also makes it easy to reference transaction records in the future. Due to the significance of these details, accuracy is paramount when filling this section. A slight error would lead to your request being denied.

In some cases, customers may want payments to be charged to a bank account and not a credit card. An authorization form that gives customers this option should collect information that the bank can use to verify the account and account owner’s details. This is also a section that needs to capture details (bank name, account holder’s name, account, and routing numbers) as recorded with the bank otherwise approval for payment may be denied. When filling this section, the specific category of bank account should be checked if it is ‘checking’ or ‘savings’ as people can have multiple accounts with the same bank.

Billing information such as address, city, state, zip code, phone number, and email address is required for verification of identification details and indicates where hardcopy bills and billing statements should sent. After the card issuer or bank charges your account, the customer will typically be notified via the means provided in this section. It is thus highly important for this information to match the credit card details to prevent the rejection of the payment request by the card issue.

An authorization statement clarifies that the customer gave explicit consent for their credit card or bank account to be charged. This statement is formatted such that it collects the merchant’s name and the figure/amount of money to be charged.

Since a credit card authorization form can be used for one-off or recurrent payments it was necessary that we include these two options in the template. If the charge is recurrent, the first option must be checked, but for a one-time payment, the second option will be checked. Also, it must be clear when each charge will be billed and for which purpose. This information provides a chronological record of events and offers enough details that can be verified by the credit card issuer or bank. The authorizing statements for each option are detailed to indicate how each charge type will be handled. For example, for recurring charges, the terms are that once the customer authorizes, you will not be required to notify them of subsequent charges unless the amount or date of payment changes.

For recurring payments, the date and frequency (weekly, monthly, etc.) of charges must be filled – for example 5 th of each month or Monday of each week.

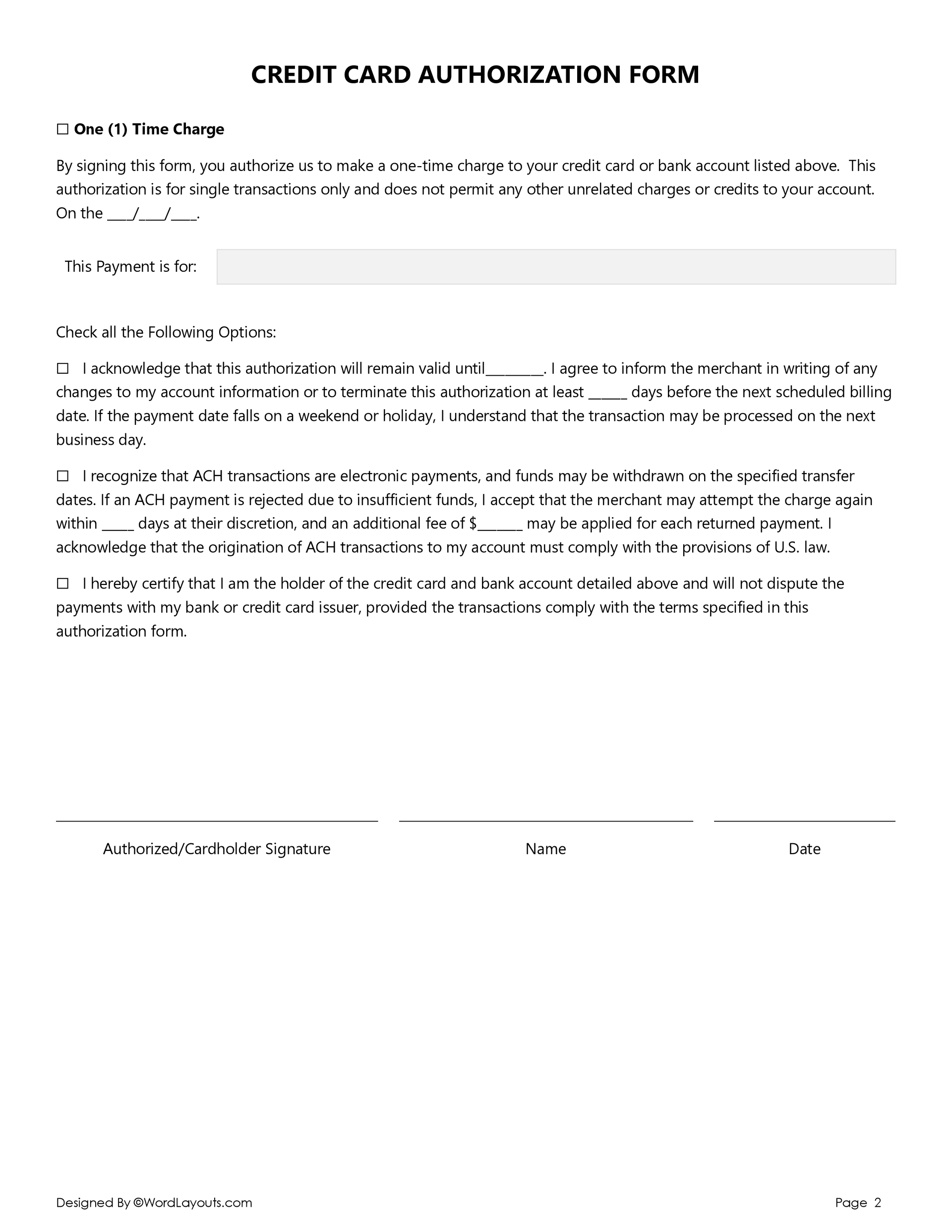

For the one-time charge, the form clearly states that this section is specifically for single transactions. To this effect, the specific date of charges must be given by indicating the day, month, and year.

A specified validity period is needed to limit the duration of the customer’s consent and give them an option to renew or get rid of previously authorized payments. When filling this section, the customer will check the boxes and input the due date of the validity and the number of days the customer has to notify you before changing account details or terminating the authorization.

Sometimes you can charge a credit card or bank and have the payment rejected due to insufficient funds. It is necessary to plan for such days by establishing conditions for such cases to prevent conflicts and make sure there is a clear way of how these scenarios will be handled. This section allows you to indicate the number of days you have to charge again after rejection and the fee he/she should expect to pay.

A signed acknowledgment or declaration of ownership of the credit card or bank account recorded in the authorization form helps establish the credibility of the document and enhances its enforcement. This prevents a situation where you have to provide further proof of authenticity should the authorization form be used in an official context such as litigation. To fill this section, the customer must check the box, sign the document, and write their name and date of signing in the appropriate boxes. These three items would meet the legal threshold required to prove the customer consented to the stipulations of the credit card authorization.

Yes. You can personalize a credit card authorization form template. Items you can modify include font types, size, color, or adding certain clauses that address the needs of the specific transaction.

You should not aim to document the customer’s CVV (card verification value) or CVC (card verification code). It is a violation of the Payment Card Industry (PCI) security standards, which aim to protect customers’ credit card data from theft and misuse.

A card issuer can decline to approve a payment request for various reasons if they establish there are justifiable reasons. Such reasons include security issues, for example, potential fraud cases, insufficient funds, and technical reasons such as user error when inputting payment information.

The form should be provided by the merchant and filled by the customer. The customer is expected to append their signature as confirmation that they consent to the content of the authorization form.