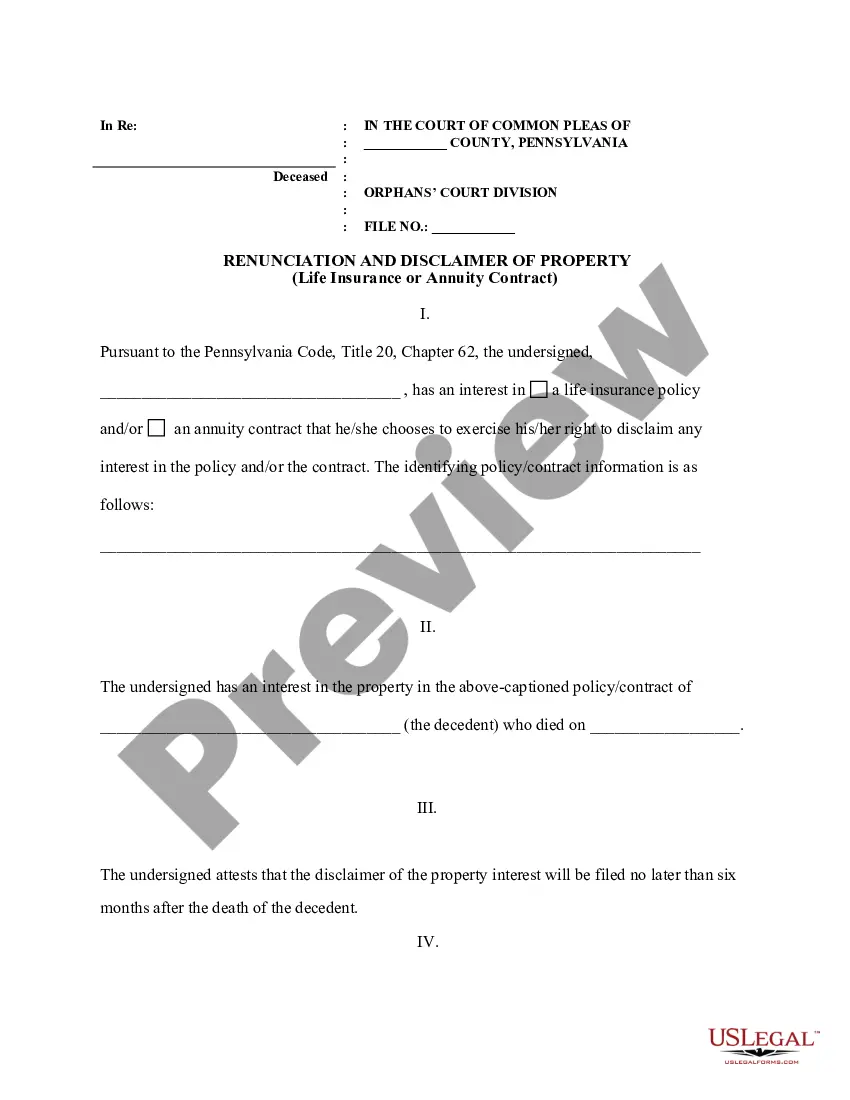

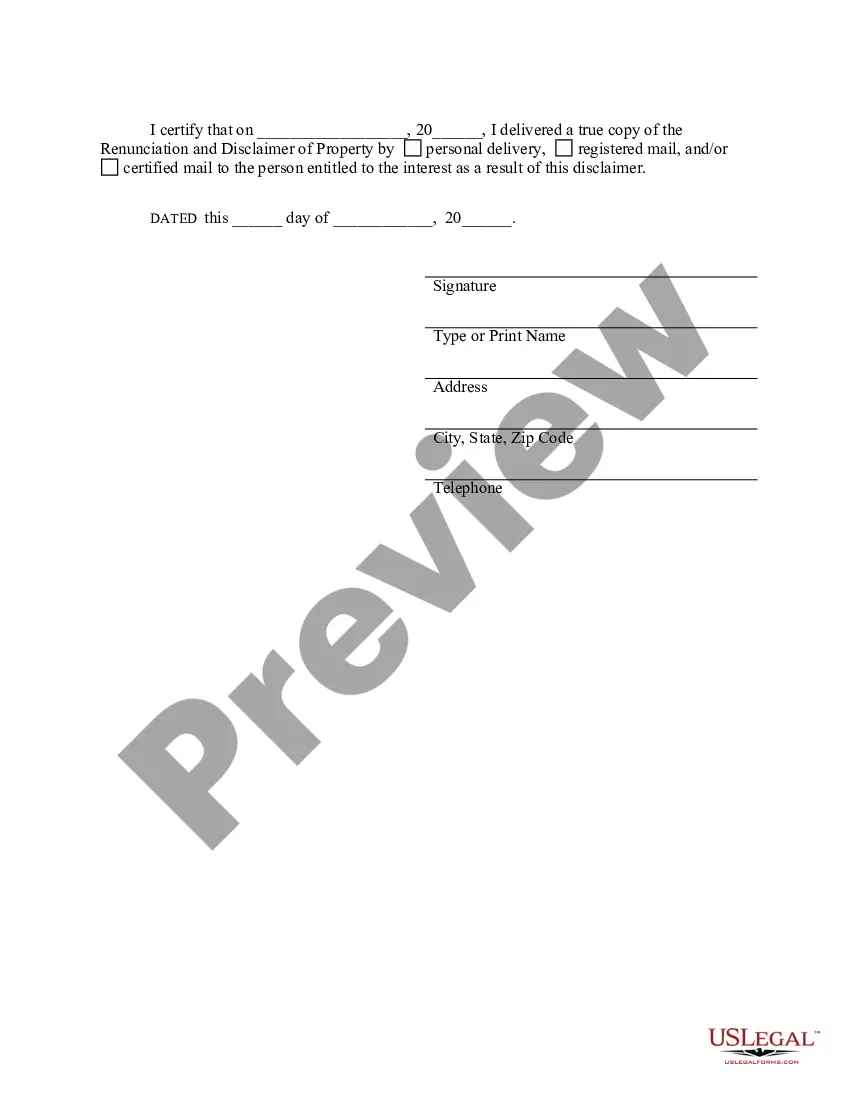

This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Pennsylvania Statutes, Title 20, Chapter 62, the beneficiary has chosen to disclaim his/her interest in the proceeds. The beneficiary also attests that the form will be filed no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also includes a state specific acknowledgment and a certificate to verify delivery of the document.

Law summary Free preview Pa Renunciation Statement

View Motion to Appoint Special Process Server

View this form View Motion and Order for Psychological EvaluationView Motion and Order for Psychological Evaluation

View this form View Purchase AgreementView Purchase Agreement

View this form View Motion to Quash due to improper extraditionView Motion to Quash due to improper extradition

View this form View Motion to QuashView Motion to Quash

View this formThe work with papers isn't the most straightforward task, especially for people who almost never deal with legal paperwork. That's why we recommend using accurate Pennsylvania Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract samples made by professional lawyers. It allows you to prevent problems when in court or handling official organizations. Find the documents you want on our site for high-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the template webpage. After accessing the sample, it’ll be saved in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Look at this brief step-by-step help guide to get your Pennsylvania Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract:

Right after completing these easy steps, you can fill out the form in a preferred editor. Recheck completed information and consider asking an attorney to examine your Pennsylvania Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Pa Renunciation Agreement Pa Renunciation Application Pa Renunciation Document Pa Renunciation Template Renunciation Contract Form Pa Renunciation Paper Legal Renunciation Any

Definitions of letter of renunciation a form sent with new shares that can be completed and returned as written notification that the person who has been allotted shares resulting from a rights issue refuses to accept them. The shares can then be sold or transferred to someone else.

This is a form where a person waives his/her superior rights to serve as Executor or Administrator of a decedent's estate.

Anyone named as an executor in a will may abandon the role by signing a renunciation witnessed by a disinterested witness, ie the witness must not be mentioned in the will, and should not be a family member. It is only possible to renounce if you have not intermeddled in the deceased's estate.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

This basically means that they are resigning from the job of Executor. Once they have renounced by signing the Deed of Renunciation, their appointment as Executor is cancelled. Someone else usually one or more of the Beneficiaries named in the Will will then have to step in and do the job instead.

A: You may need to clarify what type of administration you are referring to, but if you are asking about administration of a decedent's estate, then renunciation refers to giving up your right to be qualified as the Administrator of the estate.

In the context of the right to probate or administration of an estate, the act of either an executor or an administrator of a deceased's estate, by which he relinquishes the right to act in the administration.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

An individual can step down without stating a reason prior to formal appointment by the court. This is known as renunciation and is a legal document providing the person named in the will is not going to act as executor.

To change the state, select it from the list below and press Change state. Changing the state redirects you to another page.

Pennsylvania Change state Close No results found. Pennsylvania New Hampshire New Jersey New Mexico Rhode Island South Carolina South Dakota West Virginia Law summary Renunciation And Disclaimer of Property from Life Insurance or Annuity ContractDisclaimer of Property Interest-Pennsylvania

Pennsylvania Statutes

TITLE 20 DECEDENTS, ESTATES AND FIDUCIARIES

CHAPTER 62 DISCLAIMERS

Right to disclaim

A person to whom an interest in property would have devolved by whatever means, including a beneficiary under a will, an appointee under the exercise of a power of appointment, a person entitled to take by intestacy, a joint tenant with right of survivorship, a donee of an inter vivos transfer, a donee under a third-party beneficiary contract (including beneficiaries of life insurance and annuity policies and pension, profit-sharing and other employee benefit plans), and a person entitled to a disclaimed interest, may disclaim it in whole or in part by a written disclaimer which shall:

(1) describe the interest disclaimed;

(2) declare the disclaimer and extent thereof; and

(3) be signed by the disclaimant.

The right to disclaim shall exist notwithstanding any limitation on the interest in the nature of a spendthrift provision or similar restriction.

Title 20, Chap. 62, §6201.

Disclaimers by fiduciaries or agents

A disclaimer on behalf of a decedent, a minor or an incapacitated person may be made by his personal representative, the guardian of his estate or in the case of an incapacitated person who executed a power of attorney which confers the authority to disclaim upon his agent and which qualifies as a durable power of attorney under section 5604 (relating to durable powers of attorney) by such agent, if, in each case, the court having jurisdiction of the estate authorizes the disclaimer after finding that it is advisable and will not materially prejudice the rights of creditors, heirs or beneficiaries of the decedent, the minor or his creditors, or the incapacitated person or his creditors, as the case may be. A personal representative may make a disclaimer on behalf of his decedent without court authorization if the will of the decedent so authorizes him.

Title 20, Chap. 62, §6202.

Interests subject to disclaimer

A disclaimer in whole or in part may be made of any present or future interest, vested or contingent, including a possible future right to take as an appointee under an unexercised power of appointment or under a discretionary power to distribute income or principal.

Title 20, Chap. 62, §6203.

Filing, delivery and recording

(a) Will or intestacy. - If the interest would have devolved to the disclaimant by will or by intestacy, the disclaimer shall be filed with the clerk of the orphans' court division of the county where the decedent died domiciled or, if the decedent was not domiciled in this Commonwealth, of the county where the property involved is located, and a copy of the disclaimer shall be delivered to any personal representative, trustee or other fiduciary in possession of the property.

(b) Inter vivos transfers. - If the interest would have devolved to the disclaimant by an inter vivos instrument, the disclaimer or a copy thereof shall be delivered to the trustee or other person having legal title to or possession of the property or interest disclaimed or who is entitled thereto by reason of the disclaimer.

(b.1) Third-party disclaimer. - If the interest would have devolved to the disclaimant by a third-party beneficiary contract (including life insurance and annuity policies and pension, profit-sharing and other employee benefit plans), the disclaimer or copy thereof shall be delivered to the insurance company, employer or other obligor, as the case may be, and to the person who is entitled to the interest by reason of the disclaimer.

(c) Powers of appointment. - If the interest would have devolved to the disclaimant by reason of the exercise of a power of appointment, the disclaimer or a copy thereof shall be filed or delivered as required by the above provisions if the donor of the power is regarded as the donor of the interest or if the person who exercised the power is regarded as the donor of the interest.

(d) Real estate. - If an interest in real property is disclaimed, a copy of the disclaimer may be recorded in the office for the recording of deeds of the county where the real estate is situated and it shall not be effective as to a bona fide grantee or holder of a lien against the property who has given value therefor before the disclaimer is so recorded.

Title 20, Chap. 62, §6204.

Effect of disclaimer

(a) In general. - A disclaimer relates back for all purposes to the date of the death of the decedent or the effective date of the inter vivos transfer or third-party beneficiary contract as the case may be. The disclaimer shall be binding upon the disclaimant and all persons claiming through or under him.

(b) Rights of other parties. - Unless a testator or donor has provided for another disposition, the disclaimer shall, for purposes of determining the rights of other parties, be equivalent to the disclaimant's having died before the decedent in the case of a devolution by will or intestacy or before the effective date of an inter vivos transfer or third-party beneficiary contract, except that, when applying section 2104(1) (relating to rules of succession) or analogous provisions of a governing instrument, the fact that the disclaimant actually survived shall be recognized in determining whether other parties take equally or by representation, and except that if, as a result of a disclaimer, property passes to a fund in which the disclaimant has an interest or power which he has not disclaimed, the disclaimant shall retain his interest or power in the fund as augmented by the disclaimed property.

(c) Powers of appointment. - In applying this section to an interest that would have devolved by reason of the exercise of a power of appointment, the person exercising the power shall be regarded as the decedent or transferor, as the case may be.

Title 20, Chap. 62, §6205.

Bar to disclaimer

(a) Acceptance. - A disclaimer may be made at any time before acceptance. An acceptance may be express or may be inferred from actions of the person entitled to receive an interest in property such as the following:

(1) The taking of possession or accepting delivery of the property or interest.

(2) A written waiver of the right to disclaim.

(3) An assignment, conveyance, encumbrance, pledge or other transfer of the interest or a contract to do so.

(4) A representation that the interest has been or will be accepted to a person who relies thereon to his detriment.

(5) A sale of the interest under a judicial sale.

To constitute a bar to a disclaimer, a prior acceptance must be affirmatively proved. The mere lapse of time, with or without knowledge of the interest on the part of the disclaimant, shall not constitute an acceptance.

(b) Partial acceptance within six months. - The acceptance of part of a single interest shall be considered as only a partial acceptance and will not be a bar to a subsequent disclaimer of any part or all of the balance of the interest if the part of the interest is accepted before the expiration of six months from:

(1) the death of the decedent in the case of an interest that would have devolved by will or intestacy; or

(2) the effective date of the transfer in the case of an interest that would have devolved by an inter vivos transfer or third-party beneficiary contract.

In applying this subsection to an interest that would have devolved by reason of the exercise of a power of appointment, the person exercising the power shall be regarded as the decedent or the transferor, as the case may be.

(c) Partial acceptance after six months. - The acceptance of a part of a single interest after the expiration of such six-month period shall be considered an acceptance of the entire interest and a bar to any subsequent disclaimer thereof but shall not be an acceptance of any separate interest given under the same instrument. In construing this subsection:

(1) income for life or any other period shall be considered a single interest but separate from any interest in the principal or any additional interest in income to take effect upon the happening of a future event; and

(2) an interest in periodic payments to be made from principal or income, or both, for the life of the beneficiary or any other period shall be considered a single interest but separate from any additional payments to be made upon the happening of a future event.

Title 20, Chap. 62, §6206.

Other statutes

The provisions of this chapter do not abridge the right of a person to disclaim interests under any other statute and do not affect any additional requirements for a disclaimer to be effective for inheritance tax purposes or other purposes covered specifically in other statutory provisions.

Title 20, Chap. 62, §6207.